As more interactions move online or to mobile apps, are you making the best, first impression? Because crucial to the user experience is your payment journey.

You want your guests to be able to pay their way. Dynamic Currency Conversion (DCC) or Multi-Currency Conversion (MCC) make light work of international payments, converting prices to the customers’ currency in a transparent way.

Don’t be put off by their weighty names; in a nutshell, DCC works for in-person payments, while MCC makes it easy online and in app.

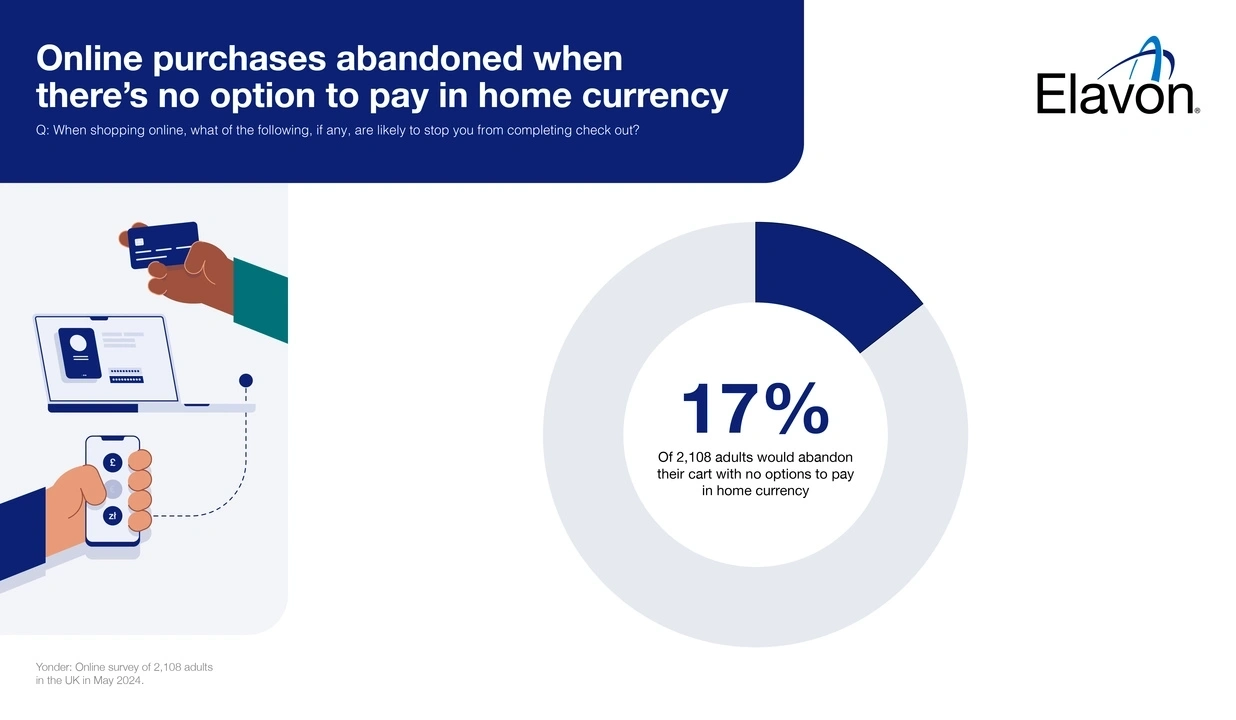

And if you’ve any doubt to its usefulness, bear in mind that almost one in five (17%) UK adults will abandon an online payment if they can’t pay in their own currency.

In fact it’s one of the top ten reasons to give up on an online purchase.

You want your guests to be able to pay their way. Dynamic Currency Conversion (DCC) or Multi-Currency Conversion (MCC) make light work of international payments.

“Hotel payment flows are changing,” says Dave Wheatcroft, Head of Hospitality for Elavon in Europe.

“For some guests, you process a token at booking, and they pay in full when checking in or checking out – which is an ideal time to offer DCC in person.

“But as business travellers and your most exclusive guests want the freedom to leave without checking out, you need to reconsider when it’s best to address currency conversion… MCC could be the answer,” he adds.

With MCC enabled on your website, the IP address of a potential guest would tell your website what currency to display, meaning there are no nasty surprises for the customer when they come to book.

DCC is turned on for in-person devices to pay at check out, in the bar or restaurant, or anywhere else you might take card payments.

The device recognises where your guest’s card was issued and gives them the choice of paying in the local or domestic currency. Costs and exchange rates are clearly displayed, again eliminating any nasty surprises for the guest when they return home.

Currency conversion that always puts your guest experience first

How does the following sound to you?

Alex plans to travel to London from Berlin and picks a hotel room online to book. Your website recognises Alex’s IP address is in Germany, so automatically shows prices in Euro. Room prices you’ve pre-set (for each currency). Alex knows up front what the cost will be in a familiar currency. As pricing is clear and familiar, trust in your site and brand rises while the likelihood of dropout at the payment point reduces. The booking continues, and you’re ready to welcome Alex as a guest – perhaps for the first of many visits.

Job done, right? Well, yes. But you can be smarter still with your currency approach.

As cross-border business booms, there’s every chance you no longer work in just one currency. Think of the costs you rack up on exchange rates and fees!

What if you had some suppliers inside and outside the Eurozone. You might pay most in GBP or USD as your functional currency, but if you kept some in Euro – like those you got from Alex - could you pay your Eurozone suppliers without running up avoidable costs?

Elavon can help you manage your whole currency conversion approach in a way that’s simple for your customer, easy for your team and brilliant for your business. To find out more, talk to us.

Related resources

Achieving best-in-class approval rates for your bookings

Our guide to navigating PSD2 SCA regulations provides travel and hospitality merchants with a guide to mastering transaction optimisation.

PSD2 Strong Customer Authentication for travel and hospitality

Embrace the changes that will protect you, your customers and your sales. Download our guide on Strong Customer Authentication for the travel and hospitality sector.

Three ways to encourage direct hotel bookings

UK adults tell us what benefits would most motivate them to book a hotel directly, rather than through a third-party agency or travel search-engine