Card reader contactless limit rising

A quarter of all UK payments are now made using contactless methods, according to the latest study by UK Finance.

The same research shows that, in 2020 alone, the use of contactless payments rose by 12% to 9.6 billion payments.

Following the successful increase in the contact limit from £30 to £45 in April 2020, the UK limit will rise again to £100 from October 15, 2021.

The decision, by HM Treasury and the Financial Conduct Authority, follows a public consultation and discussion with both the retail and banking sectors.

“Increasing the contactless limit will make it easier than ever to pay safely and securely - whether that’s at the local shops, or your favourite pub and restaurant,” said The Chancellor, Rishi Sunak, announcing the change.

“As people get back to the high street, millions of payments will be made simpler, providing a welcome boost for retailers and shoppers,” his statement added.

Although the changes will start from Friday October 15, 2021, it may take some time before the new limit is available across the whole retail industry, as it requires an update to all card readers in the UK.

What do I need to do to update my card reader’s contactless limit?

Good news: Whichever card reader type you have, if it’s from Elavon, you don’t need to do anything. It will automatically download this update at some point in the *30 days following October 15, 2021.

(*For Poynt and MobileMerchant card readers the automatic update will take place more quickly, within 10 days.)

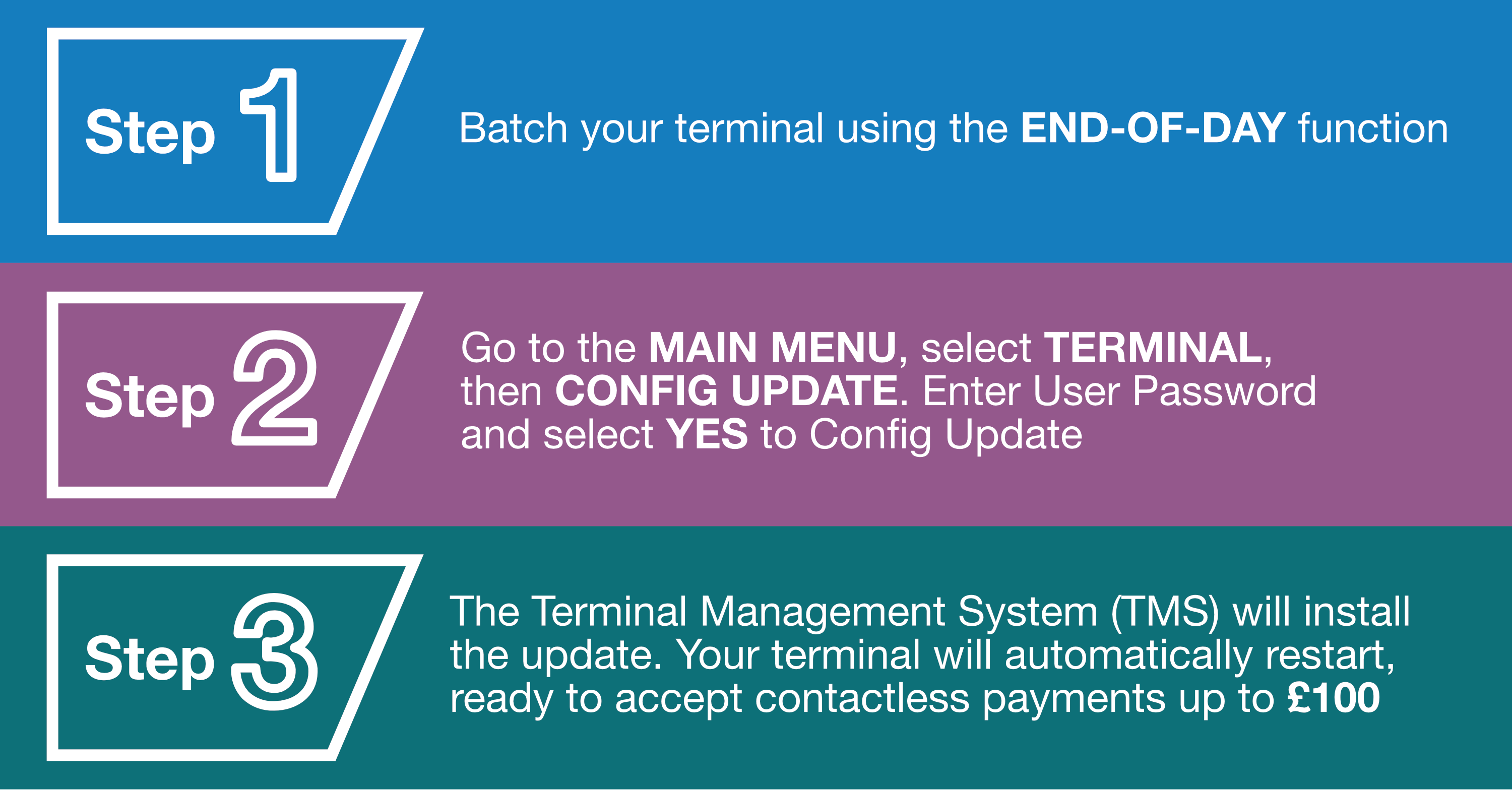

However, if you have an Ingenico card reader and want to adopt this change as soon as it’s available, rather than waiting for the automatic update, you can follow these simple steps on, or after, October 15:

If your card reader is not provided by Elavon, you will need to contact your provider to find out when the contactless limit will be updated on your device to reflect this change.

For consumers spending more than £100 there are still many ways to pay, for example through Chip & PIN, cash and alternatives such as mobile payments like Apple Pay or Google Pay which do not have an upper limit when authenticated through biometric technologies like fingerprint or facial recognition.

Contactless limit changes - Frequently asked questions:

Contactless payments are increasingly popular, accounting for more than a quarter of all payments made in the UK last year.

The new limit is being introduced as a government measure to securely improve convenience for both consumers and retailers.

The change will happen from October 15, 2021. However, with hundreds of thousands of payments devices to update, the updating process will happen gradually. It may not be available in every retail outlet on day one.

If a purchase costs more than £45 and the card reader has not yet been updated to accept £100 transactions, then contactless card payments will not be an available option. Your customer will need to enter their card and PIN as before, until the software is updated to accept the new £100 limit.

The new £100 limit is designed to balance security, convenience and consumer demand.

The higher limit will mean that your customers can now use a contactless payment to pay for more routine purchases, such as a tank of petrol or the weekly supermarket shop.

It aims to provide consumers with greater choice, depending on their circumstances and needs.

Your customers may wish to pay using contactless for amounts exceeding £45, or alternatively can opt to pay using chip and PIN, or use a mobile wallet such as, Apple Pay, Samsung Pay or Google Pay to authenticate the transaction

Every card has an in-built security check which means from time-to-time your customers have to enter their PIN to verify they are the genuine cardholder.

This change to a £100 contactless spending limit is for an individual transaction. The cumulative limit is also increasing to a maximum of £300, rising from £130. The card issuer will set its own limit, but these will not be published for security reasons.

Elavon terms of service UK (CCA)

(Sole trader, or partnership with 3 or less partners)

Elavon terms of service UK (non-CCA)

(All other customers)

Elavon terms of service (Multi-national customer)

(Multi-national customers)

Opayo Merchant Terms & Conditions

(Opayo gateway only)